In European union, it has been now 8 years since the court of justice of the European Union declared trade in used computer programs to be legitimate. All the key principles of this judgement have been summarized into this excellent post edited by Softcorner.

In parallel, trading of licenses or not, third party maintenance services providers have launched interesting alternative offers, based on pure corrective maintenance & support (remember that behind the “maintenance” word, SW vendors include both corrective maintenance & upgrade rights to deploy new releases, and the latter can only be delivered by the official SW vendor). Very often, staff of these TPM providers are former engineers coming from the SW publisher that they provide third party maintenance on: they know the products, they know how to fix it!

That being said, what is the real situation in 2020, and how should we see secondary software market as a real alternative?

Definitely, after a slow start, the secondary software market has lived a significant growth over the past 5 years. If we combine both second-hand license resellers or brokers, and third-party maintenance providers, we can just take a look at the numerous stakeholders:

More than 30% of these companies are less than 4 years old. They all claim to count dozens of thousands customers. According to the French Information Systems club of Large organizations (CIGREF), the value of unused licenses (on shelf) is estimated to 5 billion €. Gartner has even announced the tripling of the third party maintenance services market up to 1 billion $ by 2023 (2019). These two types of providers have eventually joined their efforts to promote the secondary market through the very dynamic Free ICT Europe Foundation.

So, what’s the deal now, and how should we proceed ?

4 conditions must be considered in your checklist prior to envisage wider deployment secondary software in your company:

- Maintenance lock-in mechanisms: it consists in verifying whether you have been locked-in by your SW publisher into some contractual scheme that you will be bound to stay into. For example, Server and Cloud Enrollment contracts or Enterprise Agreement contracts by Microsoft include the “enterprise” perimeter that could sometimes force the customer to license all its servers through that unique contractual vehicle (and that includes Software Assurance). For Oracle, we could talk about the matching service level clause, which may be end up to a “all or nothing” decision. In the end, it is important to know where you stand to anticipate the next step, and make sure to remove these barriers during your next negotiation (it will bring you a potential of savings much higher than simple Unit Price negotiation…)

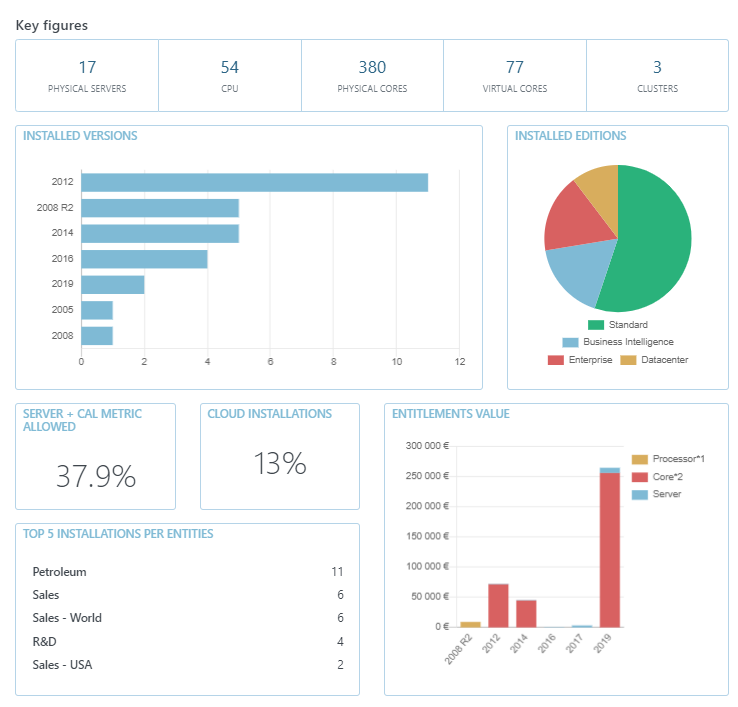

- SW Lifecycle & SW Policy: If you are an early adopter or front runner, and take advantage of the latest releases a couple of months after they become available, well secondary software market is not for you. At the opposite, if you observe that 80% of your Datacenter footprint is running a N-3 or N-4 version of the product, well just keep in mind that 3 to 5 years at most of maintenance fees equal the cost of the license. Concretely, if you run 2012 R2 databases with SA, that means that you bought the licenses in March 2014 at the latest… and you have paid the maintenance for the past +6 years at least… which is twice the price the license. Have a look to your existing footprint, discuss with your controlling on amortization policies, and dress your conclusions.

- Market liquidity: We find more and more second-hand licenses, in large quantity. Yet, the principle is that we have a meeting and agreement between sellers and buyers. That explains why, for a longtime, only “easy understanding” license assets have been sold and bought into this market : mainly desktop licenses, Office being the best example. But things have changed, and we can now find server licenses, in various metrics, Client Access Licenses… => Keep in mind that you may not be able to buy or sell licenses from Tier 2 or Tier 3 SW publishers; but for key players like MS, Oracle, IBM, SAP, VMWare, Autodesk… the market is open !

- SW Publisher relationship: Get prepared not to be in the best terms with your SW publisher, and don’t try to sell the “partnership benefits” during your next negotiation…) Concretely, it may sometimes end up with Audits, which implies that you need to be sure to be compliant prior to move to secondary software market (or possibly use second-hand licenses to get back to compliance… but I am not supposed to write it !!)

You meet these conditions for some products or SW publishers ?

OK, let’s have concrete examples now:

For Microsoft, second hand licenses are very useful:

- Just to use the most up to day version, without SA ! ?? Concretely, what is the difference between a second-hand Office 2019 and Office 2019 sold by Microsoft ? Well, 150€ per device. Nothing more to say !

- To license Microsoft server products in versions N-1 / N-2 / N-3 / N-4 environments; concretely, you may pay 10 to 20% more if you stick to a “flexible contract” on some products (e.g. Select+ versus E.A.), but you will save much more money overall.

- Because of enhanced maintenance lock-in mechanisms decided by Microsoft when you go to Azure (that so-called “Listed Provider” announcement that prevent customer to use “new licenses” bought after Oct, 1st 2019 into the cloud, if such licenses are not maintained-> OK, let’s get back to the past then with secondary software!

- You still own SQL Server+CAL licenses, but you hesitate before using them, because it is too difficult to count who access what, and make sure you have enough CALs ? Well, a SQL Server CAL was much too expensive when you bought them, that is why only a small share of your users own a CAL. With secondary software, you may reconsider that point of departure, since you can now buy second-hand CALs for a cheap price… and possibly cover your entire Datacenter with your former Server+CAL licenses (unless you have not noticed yet, the switch to the 2-core metrics has not reduced your spent !)

- And more interesting moves to consider !!

For Oracle:

- With the Matching Service Level Clause, and re-pricing policy, it is difficult with Oracle to be halfway across a fast-flowing river.

- But you can for example easily distinguish the different type of licenses you own (between Tech portfolio and Application) and drop your maintenance on one part of the licenses (e.g. Tech), and buy third party maintenance services on all your databases. Should Oracle be unhappy with it, well stay free to sign a new contract with them in one or two years time from now and negotiate the “Entity” clause so that two entities can live their own life without having to make the exact same choices in terms of maintenance service.

- Why not considering the purchase NUP licenses as well if you want to possibly divide by two your license consumption, even with secondary SW licenses ?

And same moves apply to other vendors.

Is it a price worth paying?

YES, figures are just really impressive.

Below you will find two quick examples on SQL Server & Oracle Database:

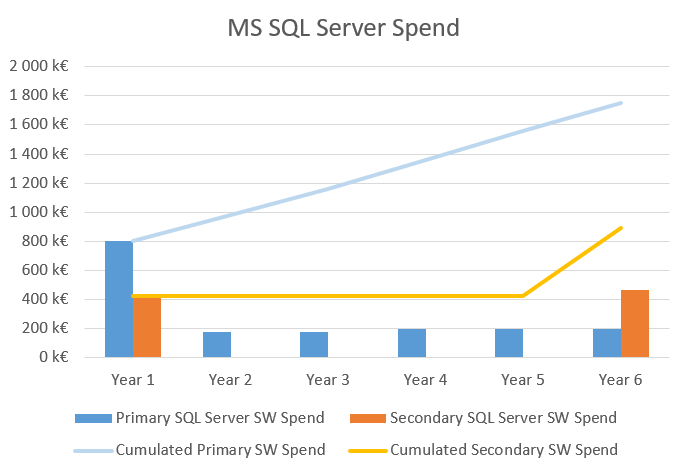

Let’s consider a medium-sized company, running ~100 SQL Server, for a total of 8 000 employees. We have the choice between multiple E.A. or SCE renewals for SQL Server Standard licenses, versus selection of not-maintained and secondary SQL Server Standard licenses, in Server+CAL metric:

- On one hand we have a quantity of 250 2-core SQL Server Std 2019 licenses, maintained through SA (3200€ unit price for LicSa initial purchase and a 10% index increase after the first 3 years)

- On the other hand, we can imagine to buy not-maintained secondary SW licenses, every five year (because we want to stay into the support policy lifecycle of MS, and we need 100 Server licenses (250€ unit price) and 8000 CALs (50€ unit price), with the same 10% index increase everytime we purchase new licenses).

Overall, we get a 49% savings compared to first scenario, which represents for our medium sized company ~200k€/y…. only for SQL Server spend.

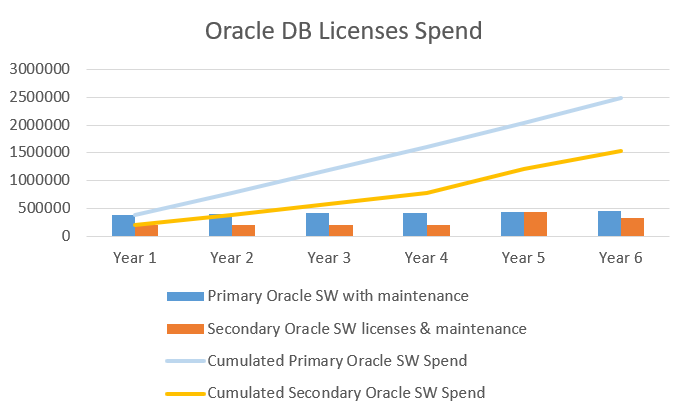

Let’s consider another medium sized company running Oracle Database Enterprise, for a total consumption of 100 CPU licenses.

- On one hand, we already own the qty of 100 licenses, and we just have to continue paying the maintenance, which equals to 22% of initial purchase (let’s imagine we obtained a 65% discount initially, and we have a 3% index increase every year).

- On the other hand, we can imagine to cut-off the maintenance from Oracle, keep our existing 100 CPU licenses which will be stuck to version 19c at most, and switch to a third party maintainer for the support services. Recurring cost will be about 50% cheaper than official maintenance. In a 5 year time from now, I may have to buy again new licenses, but why not doing it on the secondary SW market as well, and get them for a price estimated to 5% out of Oracle public price.

Overall, we get a 45% savings compared to first scenario… almost 650k€/year !

And what’s the connection with SamBox.io?

Thanks to SamBox.io you can easily check whether the 4 conditions are met, and build a real SAM Strategy with secondary software thought as a strong and sustainable leverage for cost control.

- SamBox.io embedds by default all licensing rules and contract dependancies. Should you be stuck into a lock-in mechanism, you will immediately see it with SamBox.io

- SamBox.io provides you with immediate insights on your footprint. Easy to determine your SW obsolescence in one look.

- SamBox.io helps you determine what is buyble, what is not. Everything is available into our platform, and our consultants are here to guide you to key stakeholders if needed.

- SamBox.io is the most accurate SAM calculation platform in the market. It provides you with true results, and enables you to determine whether the risk exist in case of audit or not. Moreover, SamBox.io is the only SAM platform that lets you choose which type of licenses you want to consider buying in case of shortage. Concretely, you can evaluate in a few clicks whether it is better to sort out a non compliance via the official primary channel, or via the selection of second-hand licenses.

I guess you have noticed : we strongly approved the integration of secondary Software into your SAM Strategy. So, let’s do it now!